India joins the coveted $4 trillion club

Mutual Fund

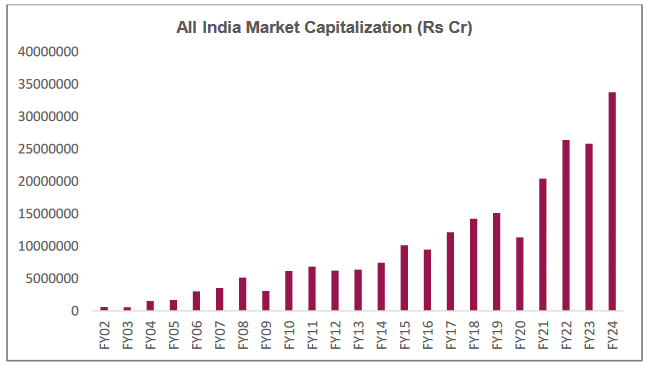

The market capitalization as evidenced by the stocks listed on the BSE and the NSE surpassed the $4 trillion mark on 29 November. India is now the fifth country after the United States, China, Japan, and Hong Kong to achieve this milestone. The overall market capitalization on the BSE touched Rs 333.29 lakh crore ($4 trillion in US dollar terms) while that on the NSE touched 334.72 lakh crore. This market cap of $4 trillion is well ahead of India’s GDP that currently stands at $3.62 trillion.

India’s market cap has risen nearly 19.5% so far this calendar year, even as China’s has seen a 5% decline and vs the US market cap growth of 17%. The move from $3 trillion to the $4 trillion mark took 30 months ie from May 2021 to November 2023. Previously, BSE-listed firms hit the $1-trillion market cap milestone in May 2007 and it took over 10 years to double. The market cap surpassed $2 trillion in July 2017.

Source: BSE. Date: 4 December 2023. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

2023 has been a good year for Indian markets. India has been in limelight for all the right reasons - an improving macroeconomic backdrop, tightly managed interest rates to tame inflation and an improved earnings outlook. India became a preferred destination for foreign portfolio investors who poured in Rs 104,972 cr or $12.8 billion in the 11 months. Meanwhile, DIIs too have invested in excess of Rs 1,68,000 cr or $20.3 billion. From being a consumption- oriented economy, India has been moving towards a consumption and investment led economy. The markets have reacted positively and rightly to this potential strength of the country. Year to end of November, the Nifty 50 gained 11.2% while the BSE Sensex rose 10.1%. The Nifty Midcap 100 posted 36.2% gains and the Nifty Smallcap 100 saw 45.6% gains.

Commenting on India’s achievement on becoming a part of the $4 trillion club, Ashish Gupta, CIO, Axis Mutual Fund said, “India’s entry to this club is a reflection of the strides the economy has made over the past few years and it is now among the top 5 globally. India is also now the fastest growing large economy and at this pace will contribute to 10% of global growth this year. The country is rewriting its growth story supported by an improved earnings outlook, de-leveraged corporate balance sheets and robust inflows from FPIs and DIIs. In our view, all the right ingredients are in place to set the growth momentum further."

Post hitting the $4 trillion mark, benchmark indices scaled further lifetime highs given the spectacular rally on 4 December following the ruling party’s resounding win in three of the five states. The Sensex 30 ended at 68,865.1, the NIFTY 50 at 20,686.8 and the Nifty Bank at 46,431.4. Separately, the recently released second quarter GDP growth numbers at 7.6% suggested continued domestic momentum, with growth being well ahead of consensus and driven by manufacturing and construction growth. On the expenditure front, growth was led byinvestments due to front loading of capital expenditure by the state and central governments. Private consumption remains a concern due to lower rural demand. On the other hand, government has been supporting growth through capex. Adding to more strength in the economy, the PMI data suggested that manufacturing continued to expand. The gauge of manufacturing remained above 50 for the 29th month in a row. In the next few years, India’s share in manufacturing could likely improve further given the government’s strong focus to make India the factory of the world.

Disclaimer

Source of Data: Axis MF Research, Bloomberg, BSE, NSE. Date: 4 December 2023

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

The Sector/Stocks mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025

-

Axis MF launches Axis NIFTY AAA Bond Financial Services: Mar 2028 Index Fund

Feb 27, 2025

-

RBI Monetary Policy: Feb 2025 New Governor ushers in a softer rate regime

Feb 7, 2025